Fascination About Investment Advisors

Table of ContentsAn Unbiased View of Investment AdvisorsThe Basic Principles Of Investment Advisors The Best Guide To Investment AdvisorsInvestment Advisors for Beginners

This is certainly not a provide or offer in any sort of territory where our team are actually certainly not accredited to perform business or where such promotion or solicitation will contrast the local regulations as well as requirements of that jurisdiction, including, however not restricted to individuals staying in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, as well as the countries of the European Association - investment advisors.Retirement life indicates various factors to everyone. It might be actually a definite factor in opportunity when you knock off, and also begin a brand-new period of life. Or it might be actually a steady method where you vary functioning hrs as your priorities work schedule. You might determine to leave behind employment as well as go back to part-time work eventually.

Discover when as well as just how to access your very, at that point discover your retirement earnings alternatives. Your main choices are actually: an account-based pension account an allowance a round figure, or a mix of these. Or even think about a shift to retired life tactic. Check out if you're eligible for the Age Pension plan, federal government advantages or elders giving ins.

Things about Investment Advisors

Analyze up the benefits and drawbacks if you are actually thinking about downsizing your property, or a reverse mortgage loan or property equity release item.

Distributions coming from previous employers' retirement life plans can easily be actually rolled over to the SRP. The Instructor Insurance as well as Annuity Organization (TIAA) is actually the single supplier of recordkeeping services for the Retired life Program profiles.

With dollar-cost averaging, you typically buy less reveals when the market is high as well as even more shares when the marketplace is actually reduced. This systematic method can easily aid you steadily build riches through diversifying the prices her explanation at which you purchase even more reveals of a sell, for instance. (Not either rate gain nor earnings is guaranteed, however.) It's a means to hedge the threat of read the article acquiring way too much at higher rates and also extremely little at low prices.

Investment Advisors - The Facts

If you do this prior to you receive utilized to possessing the added earnings, you may certainly not also notice a distinction. For beginners, you'll possess to pay out income taxes and also possibly a 10% IRS early drawback fine on earnings and pre-tax contributions you remove.

Discover how an expert can team up with you when you are actually retired to assist you decide to satisfy your earnings, insurance as well as expenditure needs.

Listed here is actually just how it operates: Allow's say you have $160,000 to spend. If you select to make use of a compact disc ladder, you might put $40,000 in a 12-month CD, one more $40,000 in a 24-month CD, as well as the same in 36- and 48-month CDs. After the first year, you can either make use of the amount of money from the 12-month CD or even reapportion it to a 48-month CD to keep the step ladder going.

If you appreciate your visit here present task, you can discover continuing to be on the crew, only in a part-time function. By doing this you may remain to obtain the satisfaction and satisfaction that your work provides while certainly not endangering the freedom you really want out of retirement life. Or, if you 'd favor to leave your present firm, you can check out various other part time jobs in industries that intrigue you.

The Best Guide To Investment Advisors

A (Lock A latched padlock) or even https:// indicates you've safely attached to the. gov site. Portion delicate information merely on authorities, safe and secure web sites (investment advisors).

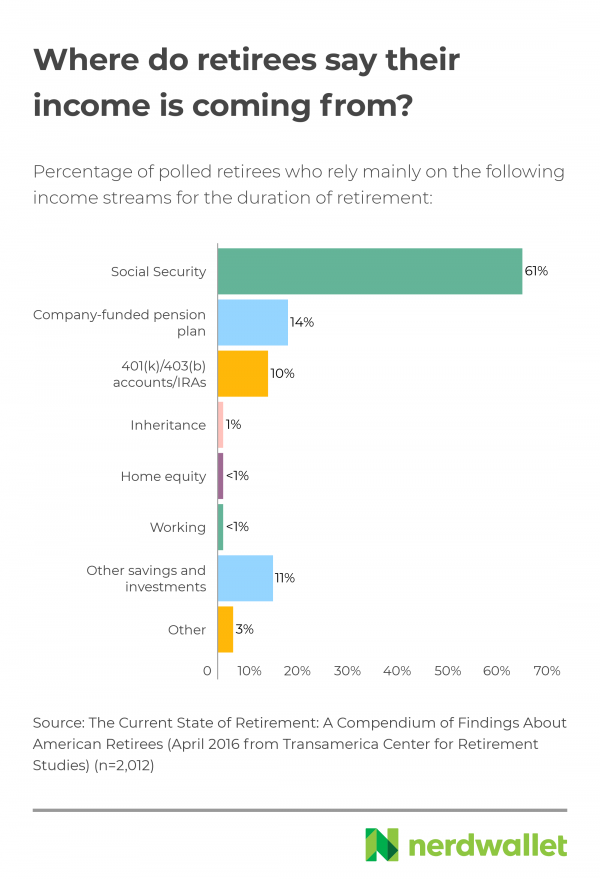

This is a fundamental source of revenue for most folks. When you decide to take it may possess a huge influence on your retirement. It could be tempting to profess your benefit as quickly as you are actually eligible for Social Securitytypically at age 62. That can be a pricey technique.